crypto tax accountant canada

The regulation of Bitcoin taxes and other cryptocurrency taxes has raised questions for many taxpayers. Whether you require cryptocurrency investment transaction reconciliations tax compliance tax return preparation and tax planning services.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

We are leading crypto tax accountants in Toronto.

. Our experts are well versed in calculating cryptocurrency transactions and its tax implications. We are one of the first blockchain accountants in Canada and have been working with a lot of different companies from the team of Ethereum to bitcoin mining companies investors developers crypto exchanges and other blockchain start-up ventures. Cryptocurrency is a digital representation of value that is NOT legal tender.

What I found was easier is downloading only the trading and manually entering the depositswithdrawals. The cryptocurrency tax software called TaxBit is a crypto tax software that claims to help people with their tax filing for digital currencies. Look no further see our comprehensive list below of certified tax professionals including CPAs crypto accountants and attorneys that work with bitcoin and crypto taxation.

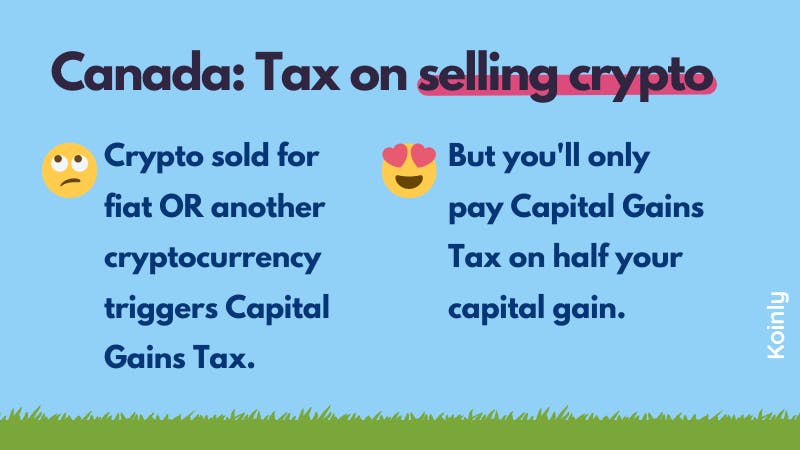

Get the most out of your cryptocurrency virtual currency Bitcoin and other blockchain-based finances. 50 of any gains are taxable and. I am a CPA and run an accounting firm providing cryptocurrency tax services to individuals and corporations across Canada I am always happy to assist and take on new clients httpswwwtsbcpaca How the CRA Views Cryptocurrency.

Perhaps this is your first tax year with crypto asset gains in which case we will also help you with high quality reports from the start. Do you need help from a professional with filing your crypto taxes. In previous years very few people have reported their cryptocurrency holdings gains and losses.

That is because I dont deposit and withdraw very often. To use a crypto tax calculator you should understand the basics of how crypto tax is calculated. This transaction is considered a disposition and you have to report it on your income tax return.

We also have a complete accountant suite aimed at accountants. It helps you calculate capital gains and income year after year. You have to convert the value of the cryptocurrency you received into Canadian dollars.

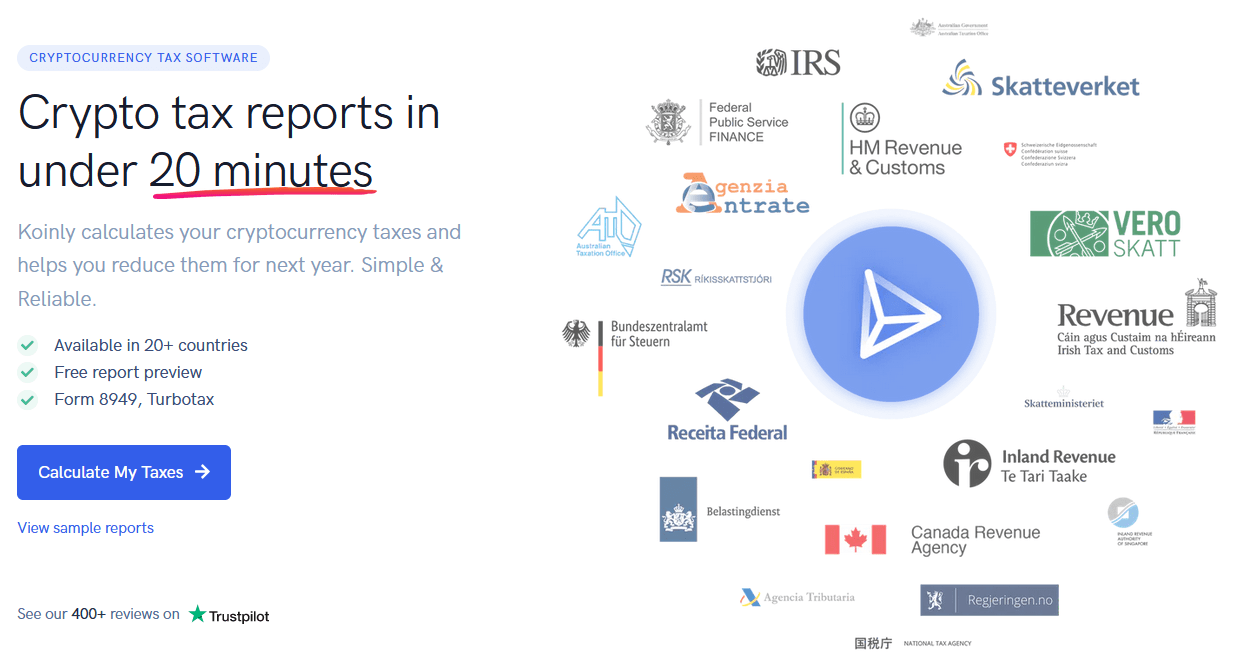

LOOKING FOR A TAX ACCOUNTANT. 295 Robinson St Suite 100 Oakville Ontario L6J 1G7 Forte Innovations. Download the CSV files manually and import them manually I used Koinlyio heard good things about cointracking too.

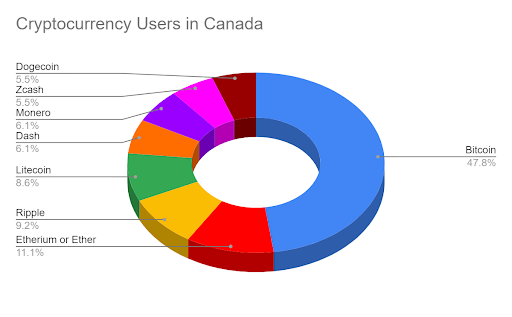

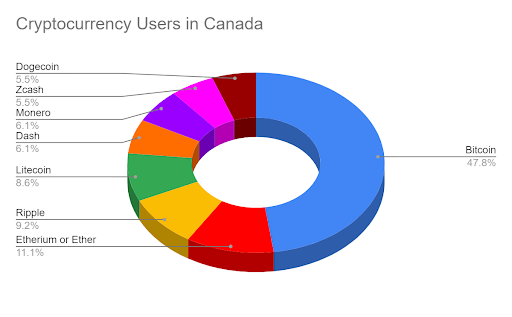

How many Canadians agree with taxing crypto. For those wondering the Candian Revenue Agency has made it clear that yes Bitcoins and Cryptocurrencies need to be disclosed on taxes this year. There were less errors this way.

CoinTrackers crypto portfolio calculator and crypto tax software has helped over 10000 users file their taxes on over 1 billion in. Theyre using this information to track Canadian crypto investors to ensure theyre reporting their crypto investments accurately and paying their fair share of crypto tax. Well untangle it for you.

In fact in 2015 only 802 people reported cryptocurrency on their returns in Canada. Our clients can focus on their core business and leave crypto accounting services of crypto tax accountant Canada. FULL TAX PREPARATION SERVICE.

With our business-based approach to cryptocurrency accounting youll get the most out of all the benefits of cryptocurrency and stay ahead of the curve whether you have an established Bitcoin-based business or view crypto as a personal hobby. We offer an extensive range of crypto taxation and accounting services tailored to the specific needs of our clients. Report the resulting gain or loss as either business income or loss or a capital gain or loss.

Our directory has tax accountants from the US Canada Europe Australasia and other parts of the world. No matter what activity you have done in crypto we have you covered. If this is you then its time to get help.

In the summer of 2018 an international coalition of tax administratorsincluding the Canada Revenue Agency CRA and the United States Internal Revenue Service IRSpromised to pool their resources and expose cryptocurrency users who dodged their tax obligations. We have a deep technical understanding of software and tax which enables us to optimise your. How is crypto tax calculated in Canada.

You need to report both your income and capital gains from cryptocurrencies in your tax return to the CRA. The Canada Revenue Agency can track your crypto investments. Bomcas Canadas professional tax accountants have a wealth of knowledge and hands-on experience in the realms of cryptocurrencies and blockchain technology which they bring to their clients.

In our survey 465 of respondents agreed with taxing crypto while 343 disagreed with taxing crypto. The tax return for 2021 needs to be filed by the 30th of April 2022. Koinly can help with your Canada crypto taxes.

Similarly your crypto taxes for the 2022 financial year must be filed by the 30th of April 2023. Our clients can focus on their core business and leave crypto accounting services of crypto tax accountant Canada. Take the burden off your shoulders.

20 said they were using software not designed to handle crypto regulations. Do you handle non-exchange activity. Deixis is a Canadian accounting firm specializing in crypto tax and accounting services for Canadian investors.

Get started today and maximize your refund. We are able to provide hands-on accounting and tax services to a wide range of businesses regardless of whether they are private or public corporations or nonprofit. These arent just generic files being generated either.

A Quick Guide to Accounting For Cryptocurrency. Canada Revenue Agency has a publication that classifies Crypto or digital currencies as a form of property versus a form of money. A further 192 said they did not mind either way.

As a result. Since then the CRA the IRS and other tax administrators have only fine-tuned the. Unit 210 12877 76.

The CRA announced theyre working with crypto exchanges to share customer information. We handle all non-exchange activity such as onchain transactions like Airdrops Staking Mining ICOs and other DeFi activity. According to the CRA.

TaxBit is a cryptocurrency tax software for Canada based on the Canadian tax law. Cryptocurrency is taxed like any other investment you make in Canada. Our directory of CPAs tax preparers and tax attorneys helps crypto traders help find a knowledgeable tax accountant for crypto tax advice planning and tax returns.

5 Best Crypto Tax Software Accounting Calculators 2022

Crypto Currencies Reporting And Taxation Maroof Hs Cpa Professional Corporation Toronto

Unreported Cryptocurrency Is Voluntary Disclosure The Right Option Baker Tilly Canada Chartered Professional Accountants

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

Koinly Review Is It Good For Canadians April 2022 Updated

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Cryptocurrencies Income Tax Implications In Canada Maroof Hs Cpa Professional Corporation Toronto

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Crypto Tax Accountant Canada Filing Taxes

Canada Crypto Tax Sdg Accountant

Crypto Tax Accountant In Canada

Additional Business Services Tax Consultant Toronto

Best Crypto Tax Accountant In Canada Sdg Accountant

Cra Audits Cryptocurrency Revised Canadian Tax Amnesty

8 Ways To Avoid Crypto Taxes In Canada 2022 Koinly

Cryptocurrency Pedram Nasseh Cpa Chartered Professional Accountant